A day after Arlington Heights officials unveiled a proposed settlement to the ongoing Arlington Park property tax dispute between the Chicago Bears and three local school districts, the team issued a brief statement Tuesday reiterating that their priority is a new stadium on the Chicago lakefront.

“Our focus is on the City of Chicago project at this time,” according to the statement provided by a team spokesman.

The response from officials with Northwest Suburban High School District 214, Palatine-Schaumburg High School District 211 and Palatine Township Elementary District 15 was much lengthier, but equally short on commitment to the proposal.

Village Manager Randy Recklaus’ proposal would have the Bears paying $6.3 million in property taxes for the 2023 tax year, $3.6 million for 2024, and negotiated annual increases of 3% to 10% the following three years based upon market conditions.

“We recognize that short-term tax arrangements will have long-term implications for all taxpayers,” said the school district officials, noting the possibility of tax increment financing districts or property tax break legislation the team has pushed in Springfield. “We are committed to continuing our work with the Village of Arlington Heights and the Bears to reach an agreement that serves the best interests of our students, taxpayers, and the community.”

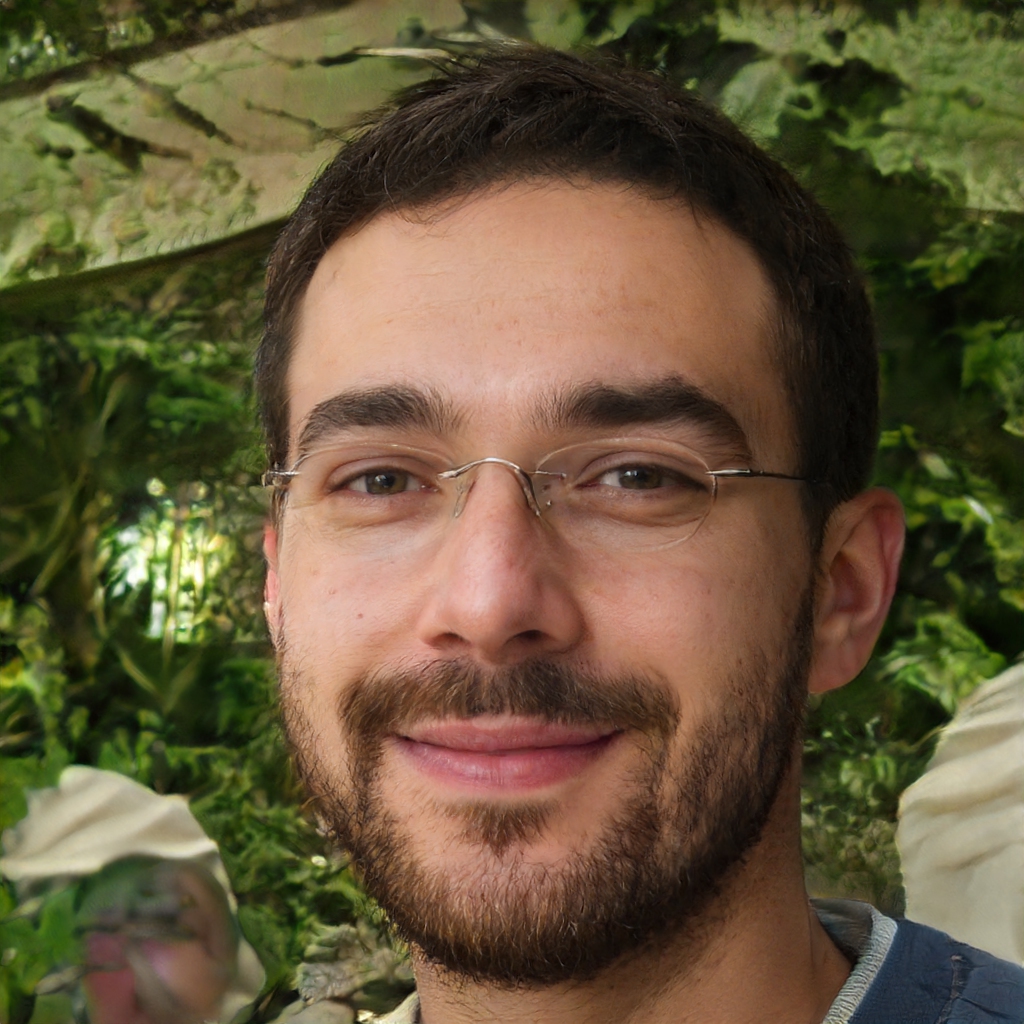

Northwest Suburban High School District 214 Superintendent Scott Rowe, from left, Palatine Township Elementary District 15 Superintendent Laurie Heinz and Palatine-Schaumburg High School District 211 Superintendent Lisa Small, pictured at a meeting with the Daily Herald Editorial Board last month, have been in negotiations with the Chicago Bears for months over property tax payments at Arlington Park.

Paul Valade/[email protected]

The school leaders fear whatever they agree to now could lock them in for decades. Under TIF, property tax payments are frozen at current levels. Additional tax revenues generated by rising property values are funneled to a village fund instead of schools and other local governments for at least 23 years.

And the so-called Payments in Lieu of Taxes financing mechanism the Bears proposed in 2022 would freeze the assessment at their Arlington Park property for up to 40 years, while annual tax payments to the schools and other taxing bodies would be subject to negotiation with the football club.

Recklaus, who publicly revealed the proposed settlement during a village board meeting Monday, formally made the pitch to the NFL franchise and school districts Feb. 27, village records show.

A spokesman for the school districts said they immediately followed up via phone after receipt of the proposal from the village manager, and they “expect to continue conversations in the near future.”

Recklaus added that he has spoken to officials from both sides since the offer was made, but confirmed that neither has formally responded to it.

The pitch from village hall came days after a Cook County Board of Review decision to set the property value of the 326-acre shuttered racetrack site at $124.7 million. That translates into a tax bill of $8.9 million for the Bears.

During their monthslong negotiations with the Bears, school district officials haven’t disclosed precisely how much they’re seeking in tax payments from the NFL club from year to year. But they reiterated Tuesday they offered several proposals — including one spanning five years — that would meet the team’s request for an average annual payment of $5 million. But the team declined the offers.

The school districts on Tuesday also endorsed the board of review’s decision on the 2023 assessment, saying it “strikes a reasonable balance” in property valuation while considering the property’s $197.2 million sale price and appraisal reports.

“Its role is to treat all taxpayers fairly and consistently, including the Bears,” the schools said.

The village’s proposal is based on the same $124.7 million property value. But Recklaus said he doesn’t think the review board sufficiently considered the property’s status: an unlicensed racetrack facility with no ability to generate revenue, and in various stages of demolition.

Arlington Heights Village Manager Randy Recklaus, pictured in the grandstand at Arlington Park in 2021, offered a proposed property tax settlement to the Chicago Bears and three local school districts — perhaps in a bid to get the NFL club to redirect its focus to redeveloping the now-vacant racetrack.

Daily Herald File Photo, July 2021

So he suggested the site be assessed at 25% of the fair market value — the common commercial standard in Cook County — for half of 2023, and at the 10% vacancy rate the other half. In 2024, he proposed assessing the property at 10% now that it’s vacant.

But the schools didn’t go as far as to endorse that methodology on Tuesday.

The village manager’s announcement Monday night came a week after the Bears announced that they’ve shifted their focus for the site of a new domed stadium away from the Arlington Park property to the parking lot on the south side of Soldier Field.